Beyond Security.

We Are The Collateral.

Unlocking Agricultural Finance in Africa

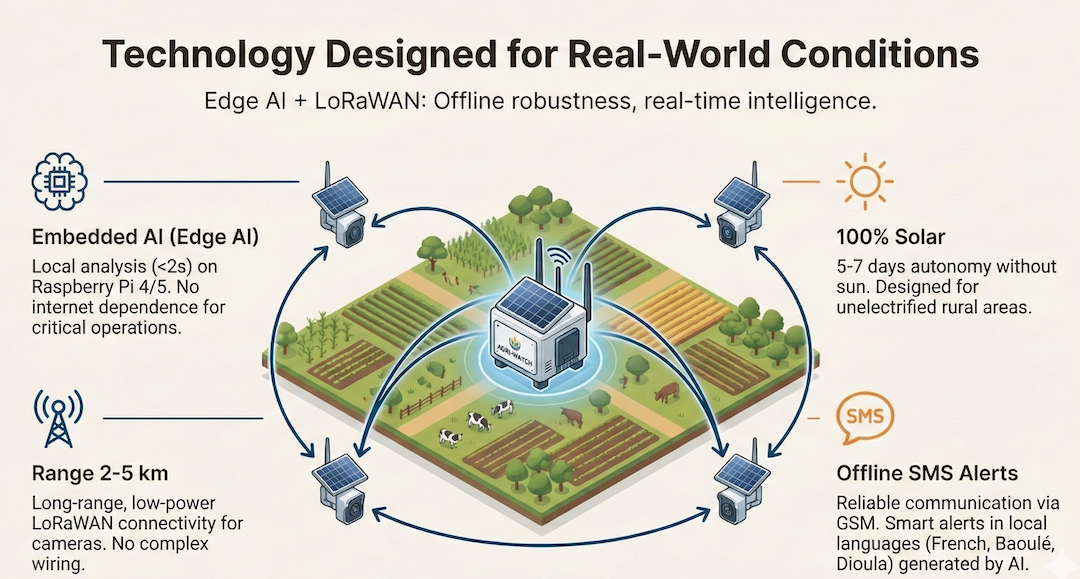

Transform livestock into bankable, insurable assets with AI-powered proof of asset certification. Powered by solar, offline Edge AI.